The private investment world has skewed what profitability really means

I would argue 99.9% of my clients operate on “adjusted EBITDA” for one reason or

I would argue 99.9% of my clients operate on “adjusted EBITDA” for one reason or

There are so many shiny things to distract management teams from actually moving the needle

There are many areas in which your competition probably excels. Are you dismissive of great

Just because a fund can raise a lot of money doesn’t mean they’re good at

CEOs in the lower middle market operate in a transition zone. It’s a proving ground

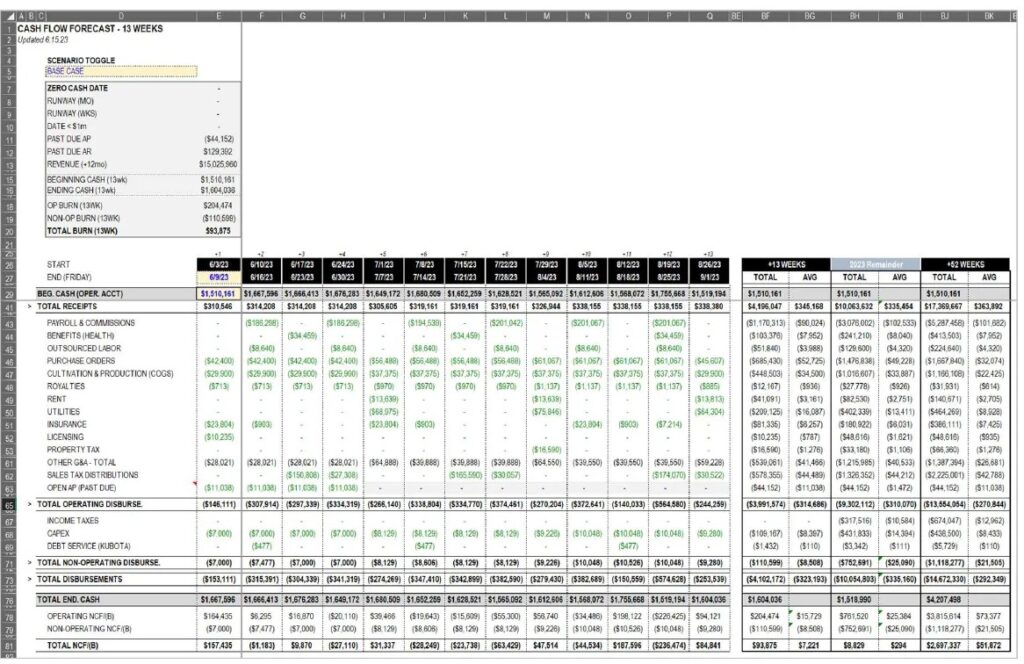

Achieving profitability targets can only be attained by holding everyone to their expense budgets.

If you want to be an extremely valuable asset to a company, get really good

One of the first frameworks on which the management team must align is the sales

Tying functions to the financials at the most granular level is why they pay us