Spending more on analytics and less on transactional roles can help companies build their finance team into a decision-making powerhouse.

In my client work, I encourage management teams to look at the percentage of their total overhead budget allocated to finance and accounting, including both technology and personnel. I want leadership to understand the percentage allocated to transactional roles and compare it to the percentage allocated to analytics. If the lion’s share of spend is allocated towards transactional roles, it could be an indication that they may not be getting the insights and visibility they need to make more informed decisions.

Your bookkeeper is not an analyst.

I see many companies often employ outsourced bookkeeping firms to handle basic accounting, accounts payable, accounts receivable, and the preparation of financial statements. Increasingly, these companies ask their bookkeeping firms for explanations on why their income statement or cash flow results from last month were favorable or unfavorable to expectations. However, these bookkeeping firms are usually not analysts and are often not equipped to answer these questions. Most firms focus only on documenting “what happened” in prior months and submitting standard financial statements to management teams. They likely focus on transactional accounting work, financial statements, and/or tax preparation support. While still important to the business, this is not proper financial analysis. If you use a bookkeeping firm to support your business, look at your contract. See if they include any verbiage on providing financial analysis or forecasting services; they probably don’t.

Financial analysis at its core is about understanding why something happened and applying this knowledge to develop scenarios that present potential future outcomes based on current business structure and management decision making.

Most bookkeeping firms will not be able to provide this to you. This is why it is so important to prioritize and rebalance your financial overhead spend. There are some easy things that can be automated to reduce transactional spend and reinvest into financial analysis and predictive insights. Successful companies make decisions based on real-time data, metrics, and KPIs that can quickly show leadership what is, or is not, working.

The 3 A’s

The “3 A’s” are a simple way to frame up the rebalance concept of a modern finance function as illustrated below. I’ve already introduced each of these concepts in Part 1, but I believe it helps to think about the concentration of each of these in your own business:

- Accounting

- Automation

- Analytics

If you were to tally up your budget for each of these areas, would you see an equal percentage of expenditure in each one? In many cases, bookkeeping expenses in the accounting sector are the largest share of the finance department. If this is the case for your business, are your bookkeepers:

- Breaking down your business into actionable insights and helping you understand future profitability by channel or product line?

- Helping you to forecast cash flow for the next 13, 26, or 52 weeks?

If not, you might need a rebalance. The more you can reinvest in the analytics and automation categories, the quicker you can create and interpret your financial data to take action on opportunities for improvement. Speed and efficiency are key. Leadership in successful companies knows that making quicker decisions provides more opportunities to control financial outcomes.

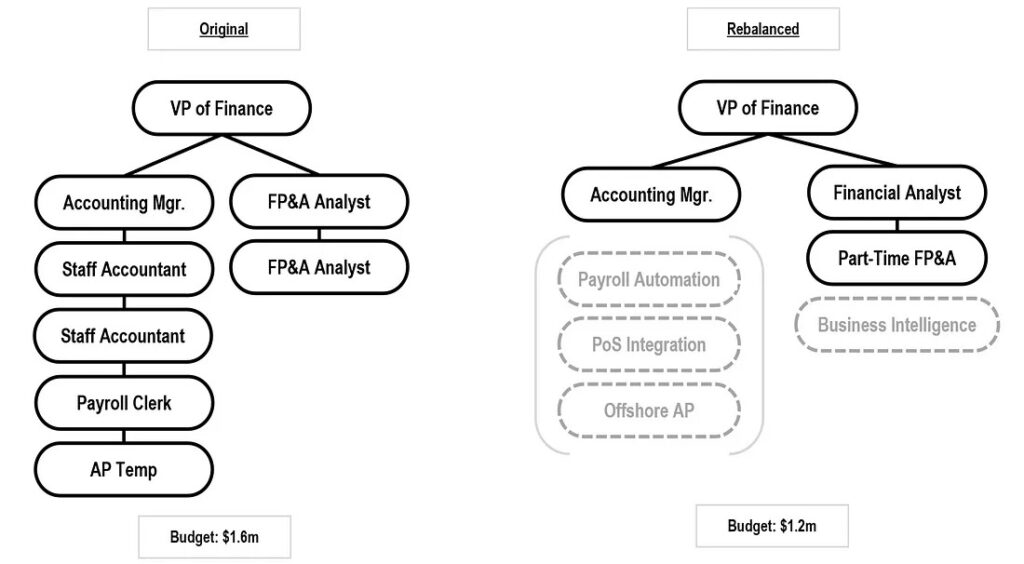

Case study: client’s transition from a transactional to an analytical function

I have included the diagram below of an actual finance department restructuring I worked on in 2022 for a large restaurant group. The left org chart (“Original”), is the original structure of the department. The total budget for the department was $1.6 million. The full $1.6 million was almost all personnel who were assigned manual tasks. On the right, the full restructure (“Rebalanced”) brought in basic transaction automation and made better use of a few business intelligence tools that the client had already employed. The new budget, even with costs associated with the reinvestment in technology, was $1.2 million. Savings from transactional function decreases were reinvested into more robust analytics and FP&A tools, still netting the client over $400,000 per year in savings.

The cost savings in this example were not realized by bringing in brand new, six-figure systems and AI to get rid of all personnel. We started the restructure process by assessing what the client currently had, then outsourcing and automating the “low-hanging fruit” such as manual roles of accounts payable and payroll.

Pre-restructuring, this client had not closed their financials in over three years. It seems counterintuitive that they would have so many accounting staff members, yet so little productivity to show for it. The COVID-19 global pandemic devastated their operations for numerous reasons — market shutdowns, personnel turnover, and operational breakdowns to name a few.

The “Original” finance function structure had a team of accountants, but no automation or business intelligence tools that the analysts could leverage to help inform management on what was happening in the business. They did not have the tools to readily adapt to the global pandemic shutdown mandates and management was forced to make essentially blind business decisions to reduce costs and manage cash flow. As a result, systems were taken offline or split into smaller components to save money, causing major financial data disruption.

There is one key insight that I see repeatedly: If upper management does not prioritize the coordination between the IT and finance teams, data integrity, quality, and financial insights will break down.

While rebalancing and integrating more efficient processes is vital, it will take time to reap results. Over the course of a year, we brought in an accounting systems IT expert to reintegrate most of the disjointed systems and automate the accounting processes. After the integration of technology into the existing processes, the internal accounting manager was able to do the work of four previous staff accountants. She could make bank reconciliations a daily habit, approve any outstanding accounts payable in the system, and still have time for general ledger management. We also partnered with an offshore accounts payable team who were experts in the client’s existing software and able to create daily automated workflows. Upgrading the client’s payroll software also helped to ensure weekly automated payroll processing. This eliminated the use of checks, PDFs, and manual work by internal staff, resulting in lower overall costs and much higher productivity. The FP&A team now has reliable data to use for both recurring reports and ad hoc analyses, thus giving management renewed visibility into the business.

Even a little bit of reinvestment into the right FP&A tools or personnel can be highly effective and give you visibility into the future.

Here is the takeaway from this situation. The client’s FP&A staff still use simple tools such as Excel for analysis. They still have accounting staff. There are still some manual processes on board. This specific company’s embrace of more automation and digital transformation was not all-encompassing, but was still highly effective.

The outcome was both explicit overall cost savings as well as implicit profitability enhancements through increased business visibility. They now have a line of sight into cash flow projections to know where cash balances should be in 6 months, and they can understand which cafes are dragging down the company P&L.

That balance looks different for each company, but investment must be made in analytics to increase visibility. This is non-negotiable.

Even making a few, small investments in analytics could have huge impacts on the business.